Depreciation interest calculator

It is the most common and simplest means of calculating depreciation. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month.

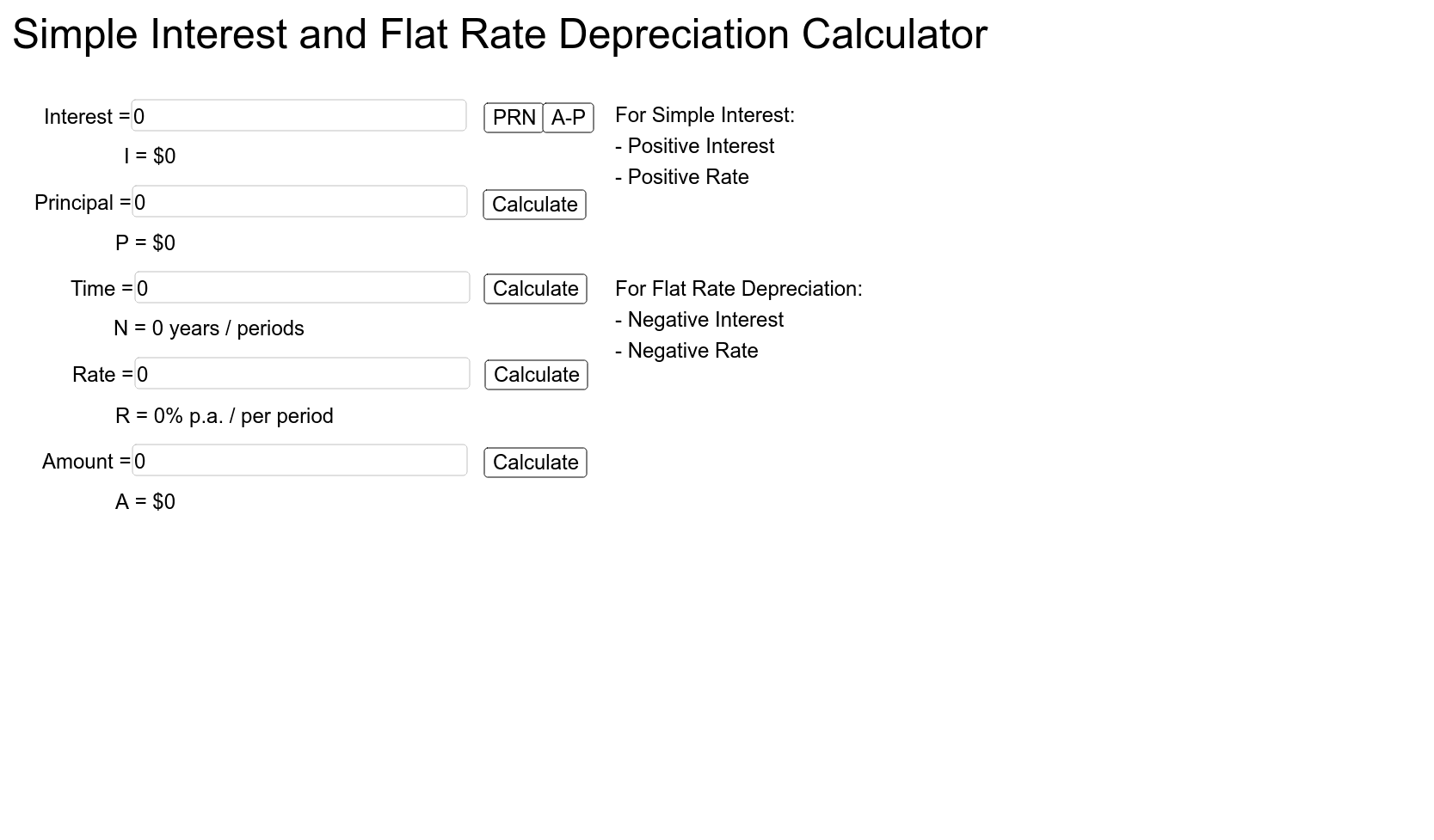

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

. Straight Line Depreciation Cost of Asset Scrap ValueUseful life. Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Straight Line Depreciation Rate Straight Line. 7 6 5 4 3 2 1 28. TaxInterest is the standard that helps you calculate the correct amounts.

The formula is expressed as. C is the original purchase price or basis of an asset. A part of the payment covers the interest due on the loan and the remainder of the payment goes toward reducing the principal amount owed.

Annual depreciation amount Original cost of asset - Salvage valuenumber of periods. Also known as a Percentage Depreciation Calculator the Declining Balance Depreciation Calculator provides visability of a declining balance depreciation is where an asset loses. For example if you have.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Next youll divide each years digit by the sum. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment.

This method is also known as Fixed Instalment Method. The MACRS Depreciation Calculator uses the following basic formula. Derek would like to borrow 100 usually called the principal from the bank for one year.

The asset cost is 1500 and its usable life is 6 years. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Straight Line Depreciation Calculator.

The calculation formula is. The following is a basic example of how interest works. When the value of an asset drops at a set rate over time it is known as straight line depreciation.

Ad Build Your Future With a Firm that has 85 Years of Investment Experience. An asset has original cost of 1000 and salvage value of. First one can choose the straight line method of.

This depreciation calculator is for calculating the depreciation schedule of an asset. D i C R i. Lets take an asset which is worth 10000 and.

The bank wants 10 interest on it. Percentage Declining Balance Depreciation Calculator. A calculator to quickly and easily determine the appreciation or depreciation of an asset.

For more information about or to do. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. It is an effective way to evenly distribute the cost over the beneficial life of the asset.

Dn rate of different assets is different. Also includes a specialized real estate property calculator. Our Resources Can Help You Decide Between Taxable Vs.

It provides a couple different methods of depreciation. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. The first step to figuring out the depreciation rate is to add up all the digits in the number seven.

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Let us take the same example of how to calculate accumulated depreciation that we used in the straight-line method. So it helps the accounting software to exactly calculate the yearly depreciation of different assets as different rates are fitted for different assets.

Where Di is the depreciation in year i.

Macrs Depreciation Calculator Irs Publication 946

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Compound Interest Calculator Daily Monthly Yearly

Straight Line Depreciation Calculator Double Entry Bookkeeping

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

Free Macrs Depreciation Calculator For Excel

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

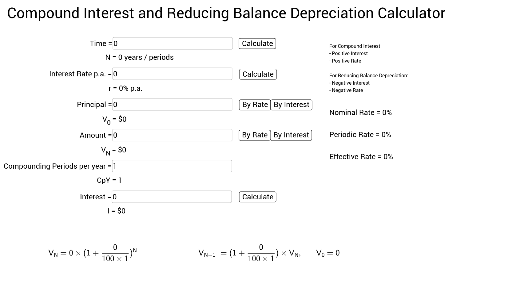

Compound Interest And Reducing Balance Calculator Vce Geogebra

Amortization Vs Depreciation What S The Difference My Tax Hack

Compound Interest And Reducing Balance Calculator Vce Geogebra

Car Depreciation Calculator Calculate Depreciation Of A Car Or Other Vehicle

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Formula Examples With Excel Template

Depreciation Calculator Definition Formula

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Compound Interest And Depreciation Youtube